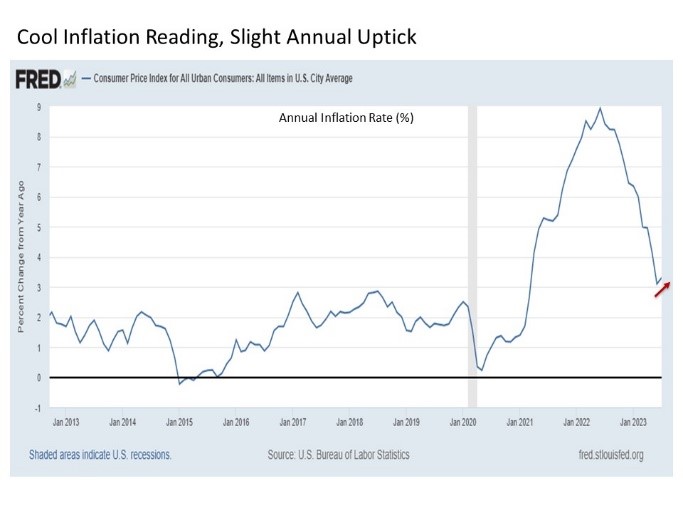

The primary risk for financial markets in the second half of the year in this Chief Market Strategist’s view is a renewed rise in inflation. Over the past year, capital markets have been cheered by the notion that the surge in inflation that began in 2021 and peaked in mid-2022 is increasingly fading into the rearview mirror, thus enabling the U.S. Federal Reserve to end its aggressive interest rate hiking cycle and even contemplate the possibility of cutting rates if needed in the months ahead. As a result, monitoring the latest inflation data as it becomes available will be important as we continue through the second half of 2023. The latest such release came Thursday morning from the Bureau of Labor Statistics with the release of the Consumer Price Index for July.

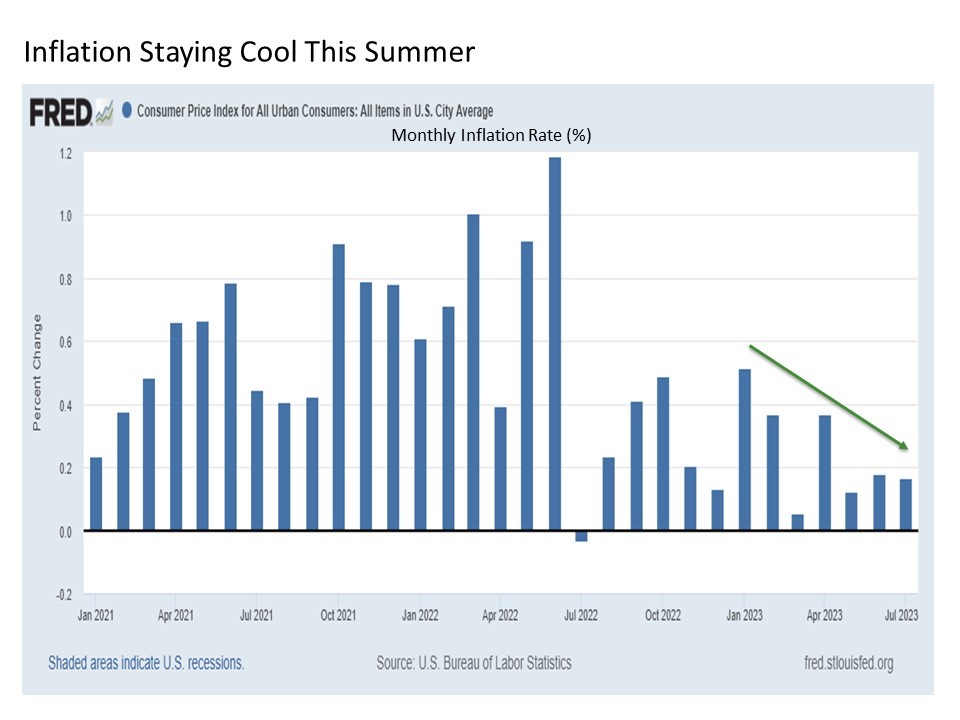

Cool inflation breezes. A primary concern heading into this latest CPI report was a hot reading on inflation. It was just a month ago when markets rejoiced following a June CPI reading that saw the headline annual inflation rate plunge from 4.2% to 3.1%, which included a month-over-month increase of just under 0.2%.

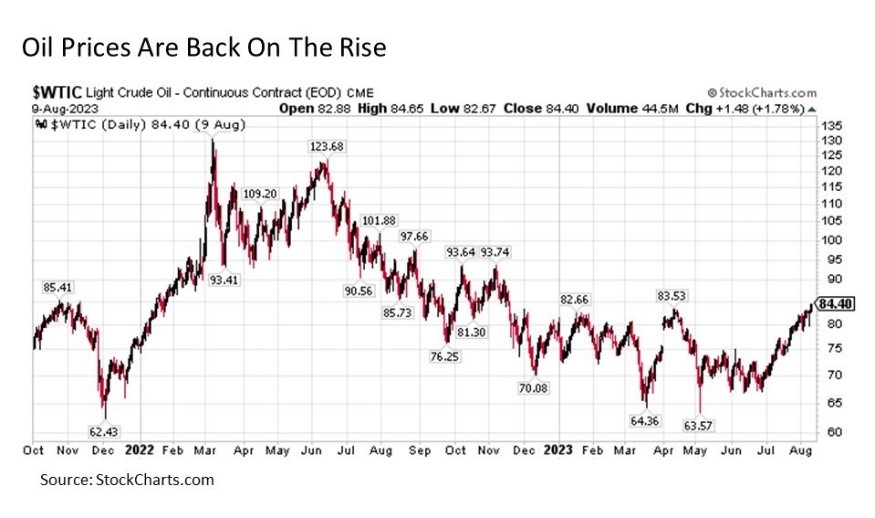

While both readings for June were resoundingly encouraging, concerns quickly started to build heading into the July CPI print that the June numbers may represent the lows for the year on inflation. With the economy chugging along stronger than expected and oil prices having risen by as much as 25% since the end of June, worries were building that inflation might start to take a renewed turn to the upside as we progressed through the second half of the year. And given that the period from early September to mid-November has been a notoriously choppy calendar year stretch for capital markets, such a rise might be the catalyst for an already overdue stock market consolidation during this time period.

Fortunately, the latest inflation reading for July brought even more notable encouragement on the inflation front. Indeed, the annual inflation rate ticked back higher as was expected, but instead of retracing as high as 3.4% for July as predicted by the historically reliable Cleveland Fed Inflation Nowcasting, the reading from the BLS came in a hair below 3.3%.

Even more constructive was the monthly reading in the CPI Index for July. For while the Cleveland Fed was projecting a month-over-month percentage increase of 0.4% on both headline and core inflation, both of which would have been considered fairly hot numbers, the announced readings came in at a far more modest 0.2%. The numbers look even better under closer examination, as the already cool 0.180% monthly reading for June actually edged a skosh lower to 0.167%. This is good stuff for the markets on the inflation front.

What to watch going forward. While the markets are rightfully responding positively to the promising latest headlines on the inflation front, it remains far too soon for the Fed or investors to raise the “Mission Accomplished” banner on the inflation fight. It is important to consider the ongoing challenges that lie ahead and the key indicators to watch as we continue through the second half of the year.

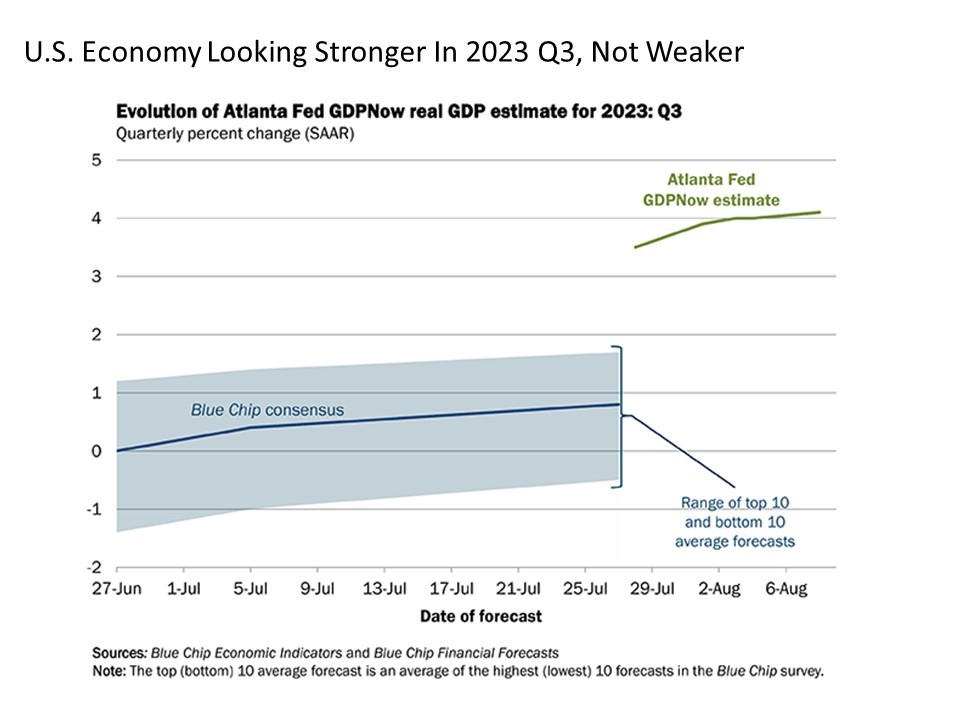

A key challenge on the inflation front is ironically the economy holding up much better than expected. Heading into 2023, the consensus base case was an economic recession in 2023 Q2-Q3. As we moved through the spring, the recession forecast shifted back to 2023 H2. And as we make our way through the summer, those dwindling analysts still anticipating a recession have moved the timeline back to the turn of the year in 2023 Q4 and 2024 Q1. But when considering that the labor market remains chronically tight with the unemployment rate lingering at historical lows and home prices continue to steadily rise supported by favorable supply/demand fundamentals, the potential remains high for the economy to remain stronger than anticipated well into 2024. To this point, the Atlanta GDP Fed Now readings as we continue through the third quarter of 2023 show an economy that is gradually accelerating, not fading, as we head toward the fall.

If it turns out that there is still too much money chasing fewer goods in a stronger than expected economy, such could be the spark for renewed inflation pressures. Given that the current folks on the Fed almost certainly do not want to repeat the missteps of the stagflationary 1970s, they are likely to act as needed by raising interest rates even further to quell any echo pricing pressures in the months ahead. And while capital markets have absorbed the overtime Fed rate hikes we’ve seen so far in 2023, they have come in the context of inflation still falling and priced in expectations that the Fed will eventually be cutting rates in 2024 (don’t count on it – a topic for another article coming to a electronic screen near you in the coming weeks), investors are not likely to be as sanguine about the Fed turning back up the dial along with inflation heating up again.

Given this primary risk, three key indicators among many others are worth watching in the days and weeks ahead.

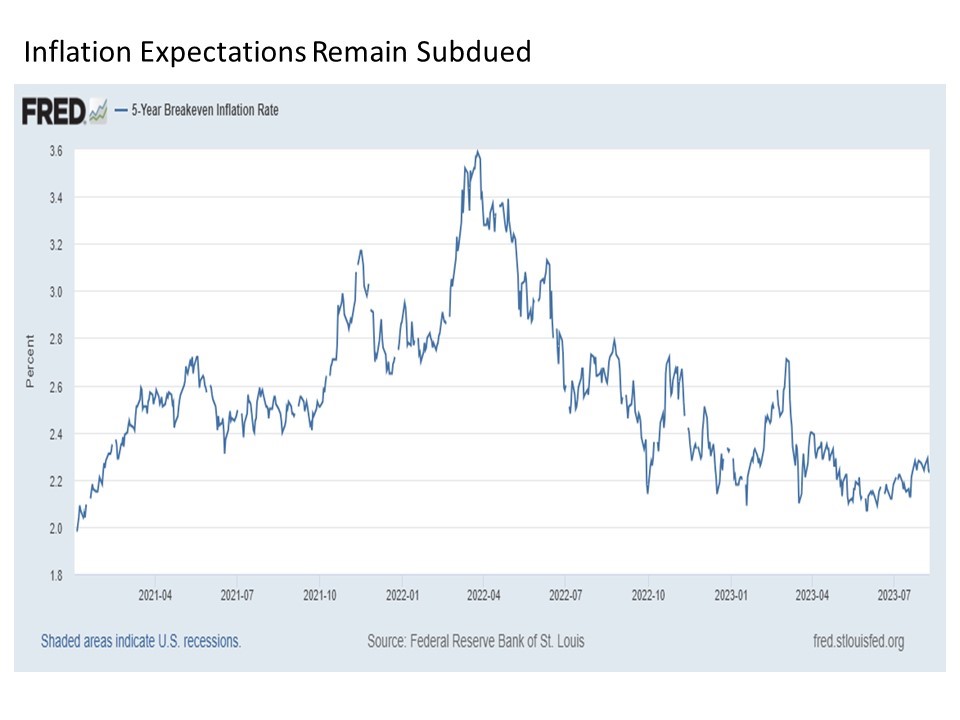

The first is the breakeven inflation rate, which is an indicator of what the market anticipates the average inflation rate will be over a future time period, say 5 years or 10 years. We can find reassurance so far when looking at the 5 year breakeven inflation rate, for while it has crept higher from recent lows at the end of May, it remains at a relatively low and very manageable 2.2% today.

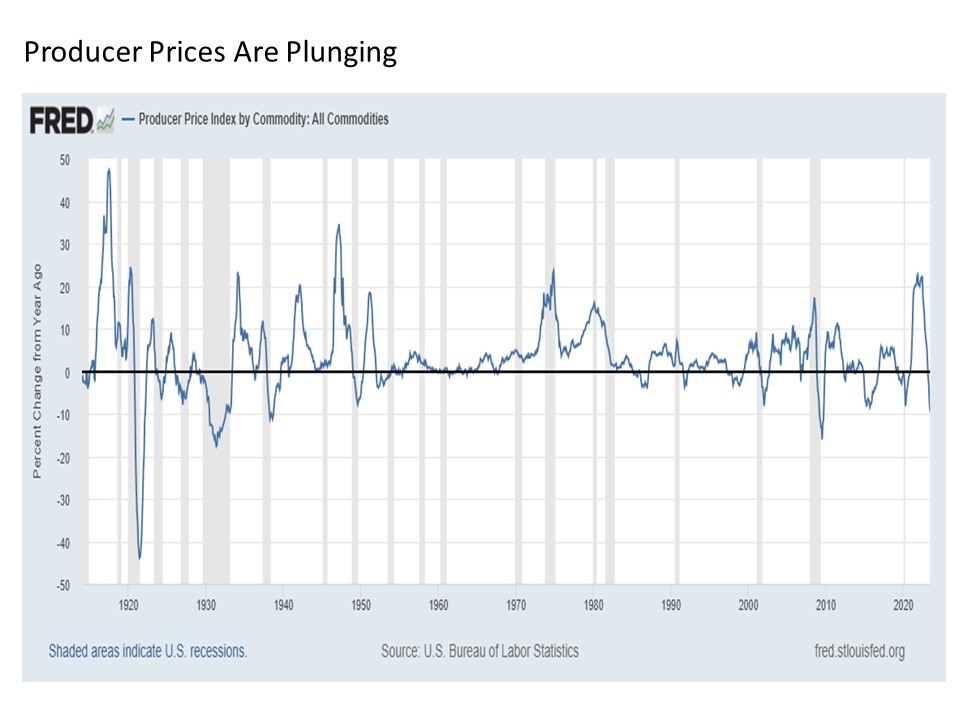

Another sign of encouragement comes from the Producer Price Index, which can be viewed as a leading indicator for the Consumer Price Index because it shows how likely producers that are making products might be to pass along costs to consumers when sending their products to market. The next PPI reading for July is set to come out on Friday, August 11, so stay tuned, but the most recent reading for June showed producer prices falling at their fastest rate outside of the Great Financial Crisis since the 1930s.

A third is oil prices as measured by West Texas Intermediate Crude (Brent Crude also works for those that are so inclined). Here we see some cracks in the armor. While oil prices matter for the headline CPI and not the Core CPI that excludes food and energy, it still matters if energy prices are screaming to the upside. And while we still remain within the oscillating range for oil prices in 2023, it is notable that we appear ready to break out above the $85 per barrel level in a push back toward $100. This is worth monitoring in the weeks ahead.

Bottom line. The good news on the inflation front keeps coming. And as long as disinflation leads over inflation, the markets are right to rejoice. But know that while the battles continue to be won, the war on the inflation front is not yet over.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Tracking #466388-2