Mega cap technology titan Nvidia posted earnings after the bell on Wednesday. The company vastly exceeded stated analysts’ expectations both on the top line and the bottom line. It also announced a new $50 billion stock buyback program (in other words, they are buying back their own stock at the equivalent value of the 188th largest company by market cap in the United States – they could buy Ross Stores in its entirety for the cash amount they are spending to buy back their own stock). Despite obliterating their numbers, the stock fell more than -7% in after hours trading following their latest announcement (apparently the whisper numbers were expecting even greater excellence, such is the peril of being priced for perfection). But the bigger story than the Nvidia stock price reaction is what this headline stealing report further confirms about corporate earnings and the underlying market backdrop. Put simply, there is a lot to like.

Yeah! A typical corporate earnings season is marked by the following pattern. Analysts typically set the bar high for earnings expectations in advance of the quarter, as it helps to justify higher current valuations. But once the earnings season officially begins, the actual earnings number along with the outlook for the next quarter or two usually get revised lower – in short, the anticipation of the future often overstates what eventually comes to pass in the present.

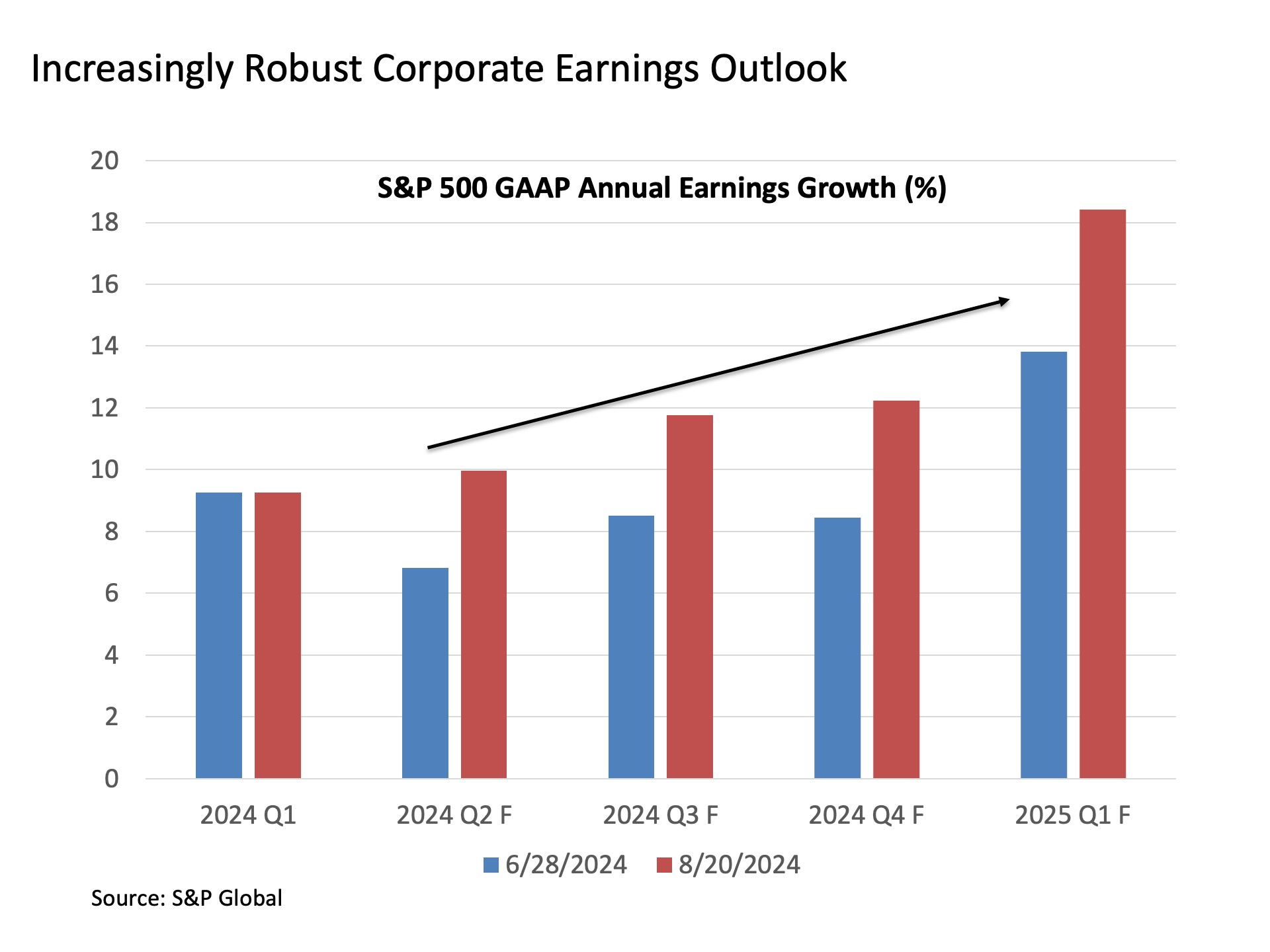

But not so this earnings season. Instead, we have seen both current reported earnings for 2024 Q2 come in vastly better than expected, but the earnings outlook for the next few quarters has been revised meaningfully higher. Now I know economists and market watchers are wringing their hands about a looming recession in the months ahead, but historically you don’t see these types of aggressive upward revisions in earnings expectations on the brink of an economic slowdown. And now that the U.S. Federal Reserve has all but committed to start lowering interest rates at their next FOMC meeting in a few weeks, this is bound to provide even more fuel to support earnings growth in the months ahead. This is good stuff for stock prices.

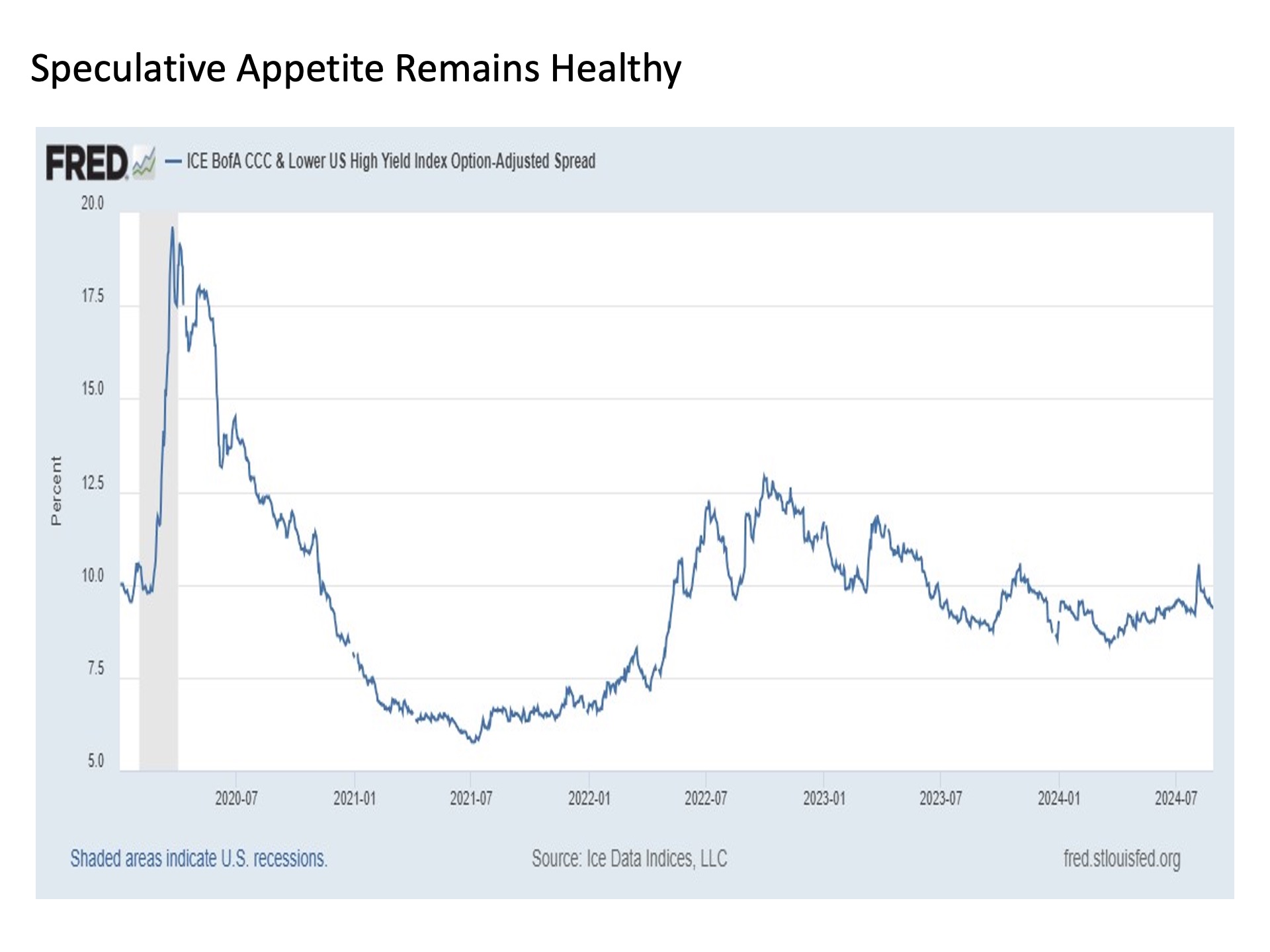

Supportive signals. Several key indicators provide added support for a favorable market outlook in the months ahead. First, CCC-rated and lower high yield corporate bond spreads relative to U.S. Treasuries, which is a good measure of the supportive speculative activity and liquidity conditions in the marketplace, remains favorable. After briefly spiking above 10% at the start of August, CCC-rated spreads have fallen back below 9.5% and remain well above the peaks from 2022 and early 2023.

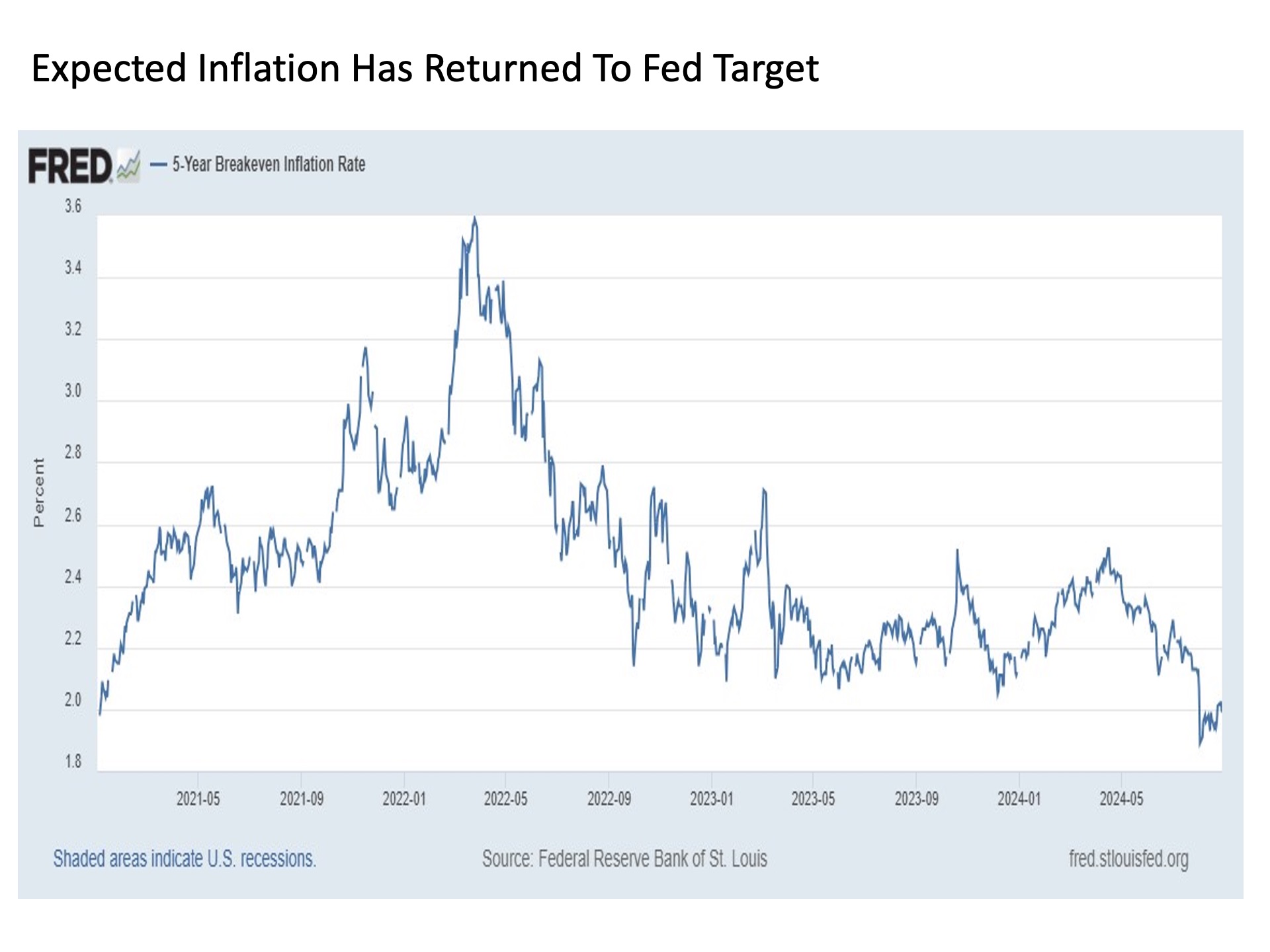

Broader inflation expectations, which remains among the biggest downside risks for markets as we continue through the remainder of 2024, have fallen all the way back to the Fed’s post financial crisis targeted level of 2%. Inflation remaining in check is huge for corporate profitability and wider profit margins, which in turn is good for stock prices.

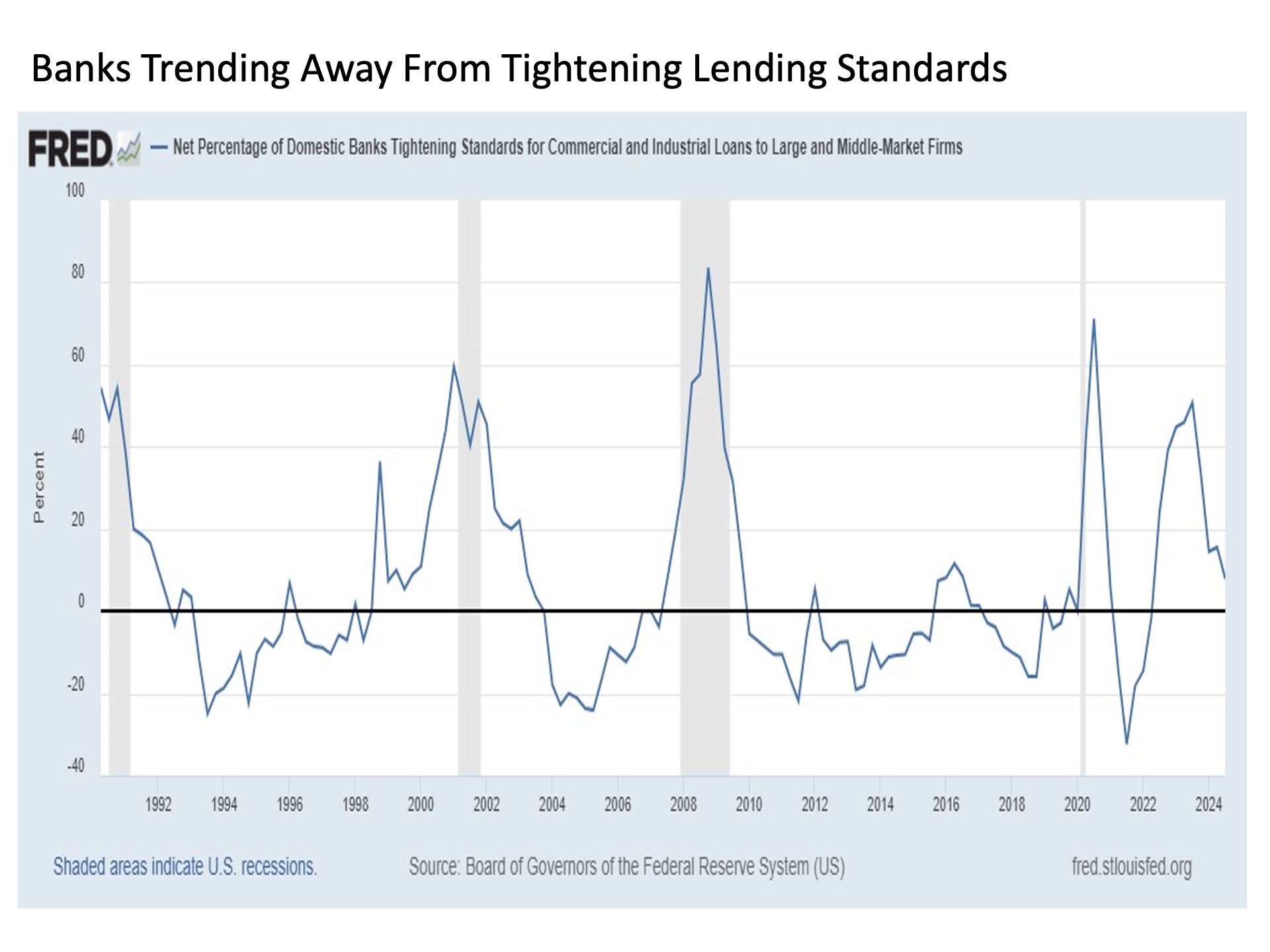

Next is the banks. During the inflation spike of 2022 and subsequent banking system instability in early 2023, the percentage of banks that were tightening lending standards had soared to over 50%, which was the highest level since the depths of the COVID crisis as recently as 2023 Q3. But since that time, the percentage of banks that are still tightening lending has faded dramatically. For example, the latest quarter saw the percentage of banks cutting back on lending activity falling to less than 8%. The fewer banks tightening lending standards, the more capital is readily available for businesses to fund growth and increase revenues and profits, which in turn supports higher stock prices.

These are just a few of the constructive signals supporting a U.S. stock market that is once again pressing toward new all-time highs.

Stimulating. So who in the stock market is benefiting from these positive trends? Lately, it has not been the usual suspects, which is arguably a good thing.

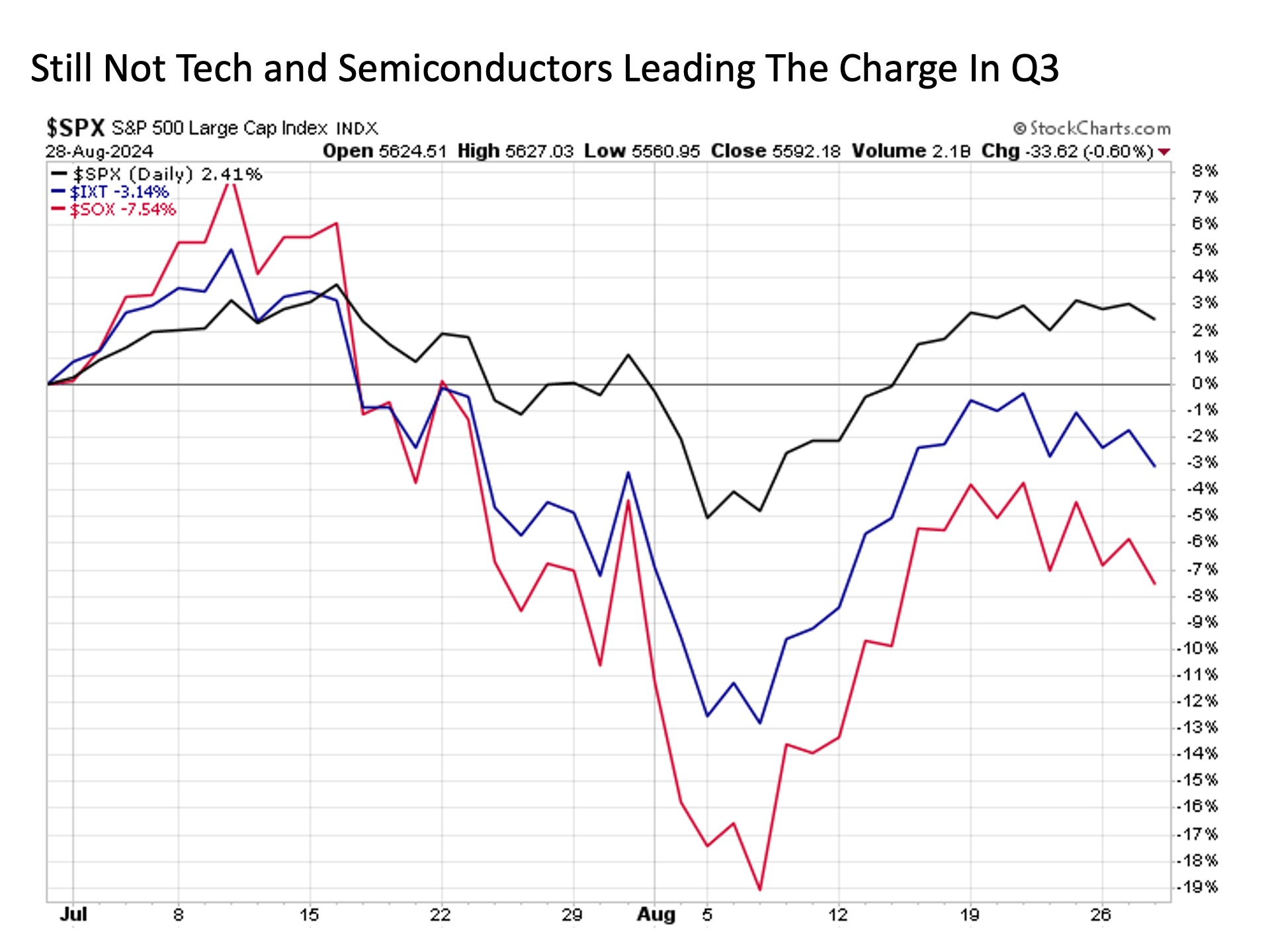

For quite a while now, market leadership has been dominated by technology in general and semiconductors in particular. This was resulting in a historically unprecedented degree of market concentration where only a select few names were responsible for the vast majority of the overall market gains. But since the start of the third quarter, tech in general and semiconductors in particular are meaningfully lagging the S&P 500.

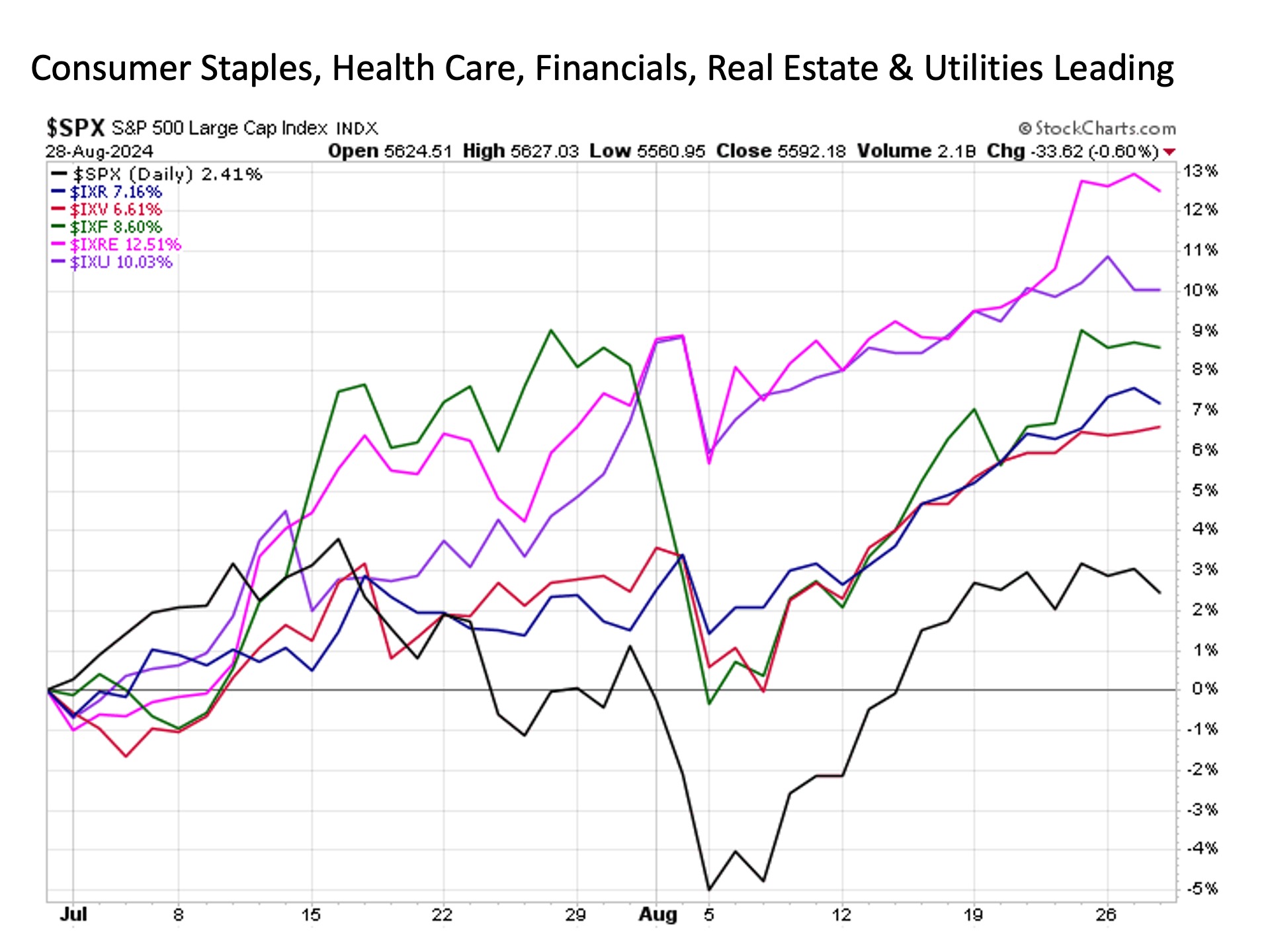

Instead, market leadership has come from long forgotten sectors such as consumer staples, health care, financials, real estate, and utilities. Overall, each of these sectors are outperforming the headline S&P 500 this quarter by as much as two to three times. This broader distribution of stock market gains is resulting in a broad 76% of stocks currently trading above their respective 50-day moving averages and a much higher than before 36% of stocks within the S&P 500 now outperforming the broader index (still a far cry from the typical 49%, but progress from the 21% reading we were seeing not that long ago).

Bottom line. The S&P 500 has returned to wrangling for new all-time highs. And the recent stock price insurgence has come with a wealth of positive economic and fundamental reading to support these renewed gains.

Bottom line. The S&P 500 has returned to wrangling for new all-time highs. And the recent stock price insurgence has come with a wealth of positive economic and fundamental reading to support these renewed gains.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 620732-1