Investors are all a flutter over the idea that the U.S. Federal Reserve is set to aggressively cut interest rates in 2024. It was a primary narrative behind why both the stock and bond market rallied so strongly in November and December of last year. And the debate about how many rate cuts and when ranks at the top of the list of discussion topics in the financial news media today. So will the Fed actually cut rates in 2024? If so, why? And what are the market implications if they eventually deliver to the market what it so eagerly expects?

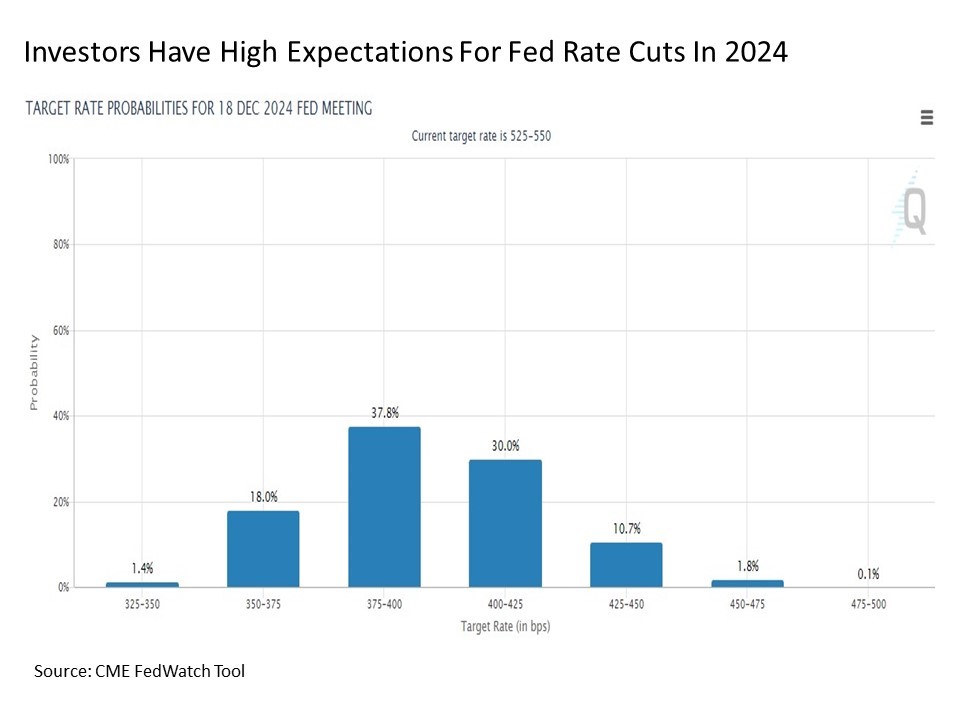

Rate cuts? It’s not just pundits squawking with visions of Fed rate cuts in their head. Consider the CME FedWatch Tool, which determines probabilities for the U.S. Federal Reserve making changes to their effective fed funds rate based on what the market is pricing in the 30-day fed funds futures pricing data. If one believes in the notion that price is truth, then traders are putting their money where their mouths are with these predictions.

Based on the chart above focusing on target rate probabilities emerging from the last of the Fed’s eight upcoming Open Market Committee meetings this year in December 2024, the market is not only pricing in a 100% probability that The Fed will start cutting interest rates this year, but a better than 50% chance that they will lower the fed funds rate by as much as 150 bps. This amounts to six quarter point rate cuts, which is a lot in any given year.

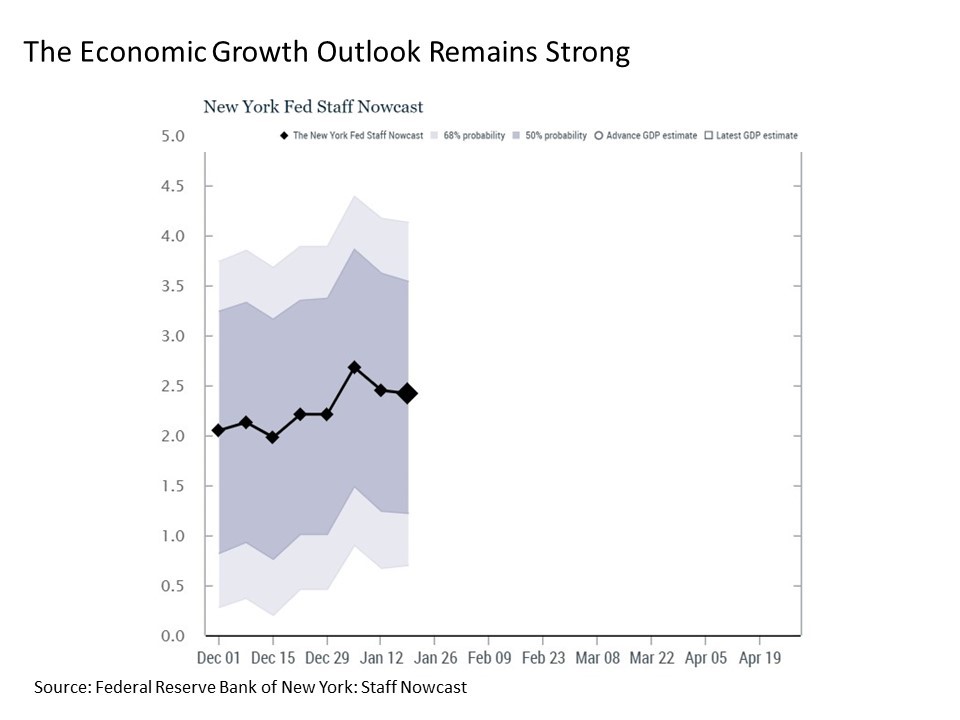

But this raises an important question. What exactly would compel the Fed to start cutting interest rates this year, much less as soon as the meeting after next on March 20? After all, we are just emerging from the worst inflation outbreak in the U.S. since the 1970s, and we had our first look at 2023 Q4 GDP that showed the economy may have grown much faster than expected to close out last year. And current forecasts for 2024 Q1 growth is gradually rising in the 2.5% range already.

Given that the Fed very likely does not want to repeat the missteps of the stagflationary 1970s where they repeatedly cut interest rates too soon during recessions after inflation came back down only to see pricing pressures spike to new heights, it is reasonable to think policy makers would be more prudent in repeating such steps today, particularly when economic growth is continuing to chug along. But rate cuts are what the market is expecting, so let’s take a closer look.

The case for rate cuts. A reasonable case can be made for cutting interest rates sooner rather than later. It’s not necessarily one that this Chief Market Strategist endorses, but it is always important to maintain an open mind. First, while the nominal effective fed funds rate remains steady in the 5.25% to 5.50% range, the fact that core and headline inflation continues to come down means that the real effective fed funds rate adjusted for inflation continues to rise.

As a result, this measure has now risen to its highest levels this millennium. And while headline GDP growth may still be steaming ahead, we are seeing a variety of signs of economic strain and weakness underneath the surface. This includes the contracting U.S. Index of Leading Economic Indicators from the Conference Board, the net national savings as a percentage of gross domestic income in this country turning decisively negative for the first time since the financial crisis, and various data suggesting that consumers are increasingly relying on debt as bankruptcy levels rise are just a few of the readings suggesting that further economic weakness may lie ahead. This coupled with expectations that inflation pressures will continue to become increasingly subdued in the years ahead as evidenced by the 5-Year Breakeven Inflation Rate suggests that the Fed may have the flexibility to act preemptively in loosening already historically high real fed interest rates to a more neutral level.

Implications of Fed rate cuts. I’m not breaking any new ground in stating that capital markets – stocks, bonds, commodities, precious metals, you name it – are enthusiastic about the prospects of a fresh round of rate cuts from the Fed. Even the notion that the Fed just might, maybe, possibility think of talking about the idea of possibly lowering interest rates is enough to get investors all jazzed up. But given we’ve had a market that’s been running on the notion for nearly three months now, what should we reasonably expect going forward if these rate cuts actually come to fruition?

Let’s start with stocks. It was reasonable to think coming into 2024 that stocks might take a breather following an explosive November and December. And while stocks did stumble a bit out of the gates to start the New Year, they quickly regained their footing and advanced to new all-time highs above their previous January 2022 peaks on the S&P 500 (it should be noted that U.S. mid-caps, U.S. small caps, developed international and emerging markets still have a long way to go to make similar claims – is that the aroma of opportunity . . .). As a result, the S&P 500 continues to not only trade at the very top end of its trading range dating back to the October 2022 bear market lows, but the index is now overbought with an RSI reading north of 70. So while Fed rate cuts make spark the verve of stock investors, it would be not only reasonable but healthy to see the headline index have some sort of -5% to -7% pullback to clear out some of the excesses and reset the market for its next move higher.

The prospects are more favorable for the bond market in general and the U.S. Treasury market in particular. Yes, the 10-Year U.S. Treasury yield dropped nearly 25% from its October highs near 5% to below 3.8% to close out December – since price moves higher when yields move lower, this was a dynamite rally in bonds. But since the start of the year, the 10-Year U.S. Treasury yield has backed up toward 4.20%. Tying back to the point about stocks above, this falls squarely into the healthy correction category for bonds in resetting for a next move higher. Not only have yields fallen back to their 50-day moving average support at the blue line on the chart below, but current yield levels near 4.20% are effectively where the bond market bottomed at 4.25% more than 15 months ago now in October 2022. And given that inflation is the primary determinant of bond returns over time, it’s worth noting that pricing pressure have fallen A LOT over this same time period, hence all of the buzz about the Fed cutting interest rates as soon as two months from now. Still smelling more of that upside opportunity. . .

Grain of salt. With all of this being said, it is important to keep the following in mind when it comes to Fed rate cut expectations. At this time a year ago in January 2023 when the fed funds rate was in the 4.25% to 4.50% range (a full percentage point lower than where it is today), the market was pricing in two more rate hikes through March 2023 to 4.75% to 5.00%, and that the Fed would subsequently start cutting interest rates by September 2023 with two quarter point rate cuts in the bag by the end of 2023 bringing the funds rate back to 4.25% to 4.50%. Um no. Turns out we got four quarter point rate hikes that continued through July 2023 and no rate cuts. So even if the market is pricing something in with 100% probability, just like a weather forecast, it doesn’t necessarily mean it’s going to happen.

Bottom line. Markets are all whipped up about the prospects of Fed rate cuts in 2024. If this comes to pass as the current futures pricing suggests, expect a generally favorable response across capital markets as long as inflationary pressures remain in check. As for specific upside, bonds actually offer more attractive directional upside than stocks under this scenario at the present time given their recent pullback. If the S&P 500 experiences a similar cleansing of the recent late 2023 froth, this would provide a more solid footing for comparable upside potential under this scenario.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 533063-1.