The big news this week was of course the Fed’s latest rate hike of 75 basis points and their summary of economic projections. That makes it 300 basis points so far this year. 25 in March, 50 in May, 75 in June, 75 in July, and now 75 in September. This has all been quite a shock to the system but obviously much needed to help reduce inflation. Listening to Powell’s press conference, he certainly made it a point that bringing down inflation is the Fed’s number one goal and vowed to “keep at it”. He also answered several questions on the “pain” theme he introduced at Jackson Hole back in August and reiterated that meant we should expect to see a slowing in the economy. In other words, a “sustained period of below trend growth”. And he did make it a point that by the end of 2022, rates should go up by an additional 125 basis points. This pretty much implies we should see another 75 bps hike this year. A full recap of his press conference is here.

As we continue to think about inflation, one thing that comes to mind is the old saying “there are two sides to every coin”. This is a pretty simple way to think about inflation right now (and communicate to your clients) because Powell and the Fed are basically controlling one side of “the inflation coin” when they raise rates. The other side is the supply chain. Which we should not lose sight of. Because as supply chains improve, prices will obviously come down. Powell and the Fed have to know that. And they have to be factoring that in when deciding how much to raise rates. So they don’t shock the system too much. Plus, general market sentiment when they raise rates. So in that context, future rate hikes may not be as aggressive, and given this latest hike has now been the third 75 bps change, rates may not go above that level at future Fed meetings. They may actually come down over time too. Which Powell has already eluded to in prior press conferences. Of course, this is all “data dependent” as Powell has also made very clear, but the point is there are two sides to the coin here.

Another “two-sided” concept to think about is rates and jobs. Because as rates go up, that puts pressure on the consumer and people won’t buy as much. Such as on their credit cards. Which slows business down in general. So, jobs might take a hit because companies won’t need to hire as much. The Fed has to be thinking about that too as part of their dual mandate. It’s all basically a balancing act.

In other news this week, chips made headlines on news of a potential “Chip 4” alliance between the US, Taiwan, South Korea, and Japan. If that comes to fruition, that may bode well for the chip companies we recently purchased in our stock models such as AMD and Micron.

As we enter this new phase in our economy with another rate hike this week, we should continue to see volatility in the markets as the inflation debate continues on what the Fed is going to do next. That leads us to continue to focus on defense and quality in the models. But as long as officials navigate around this uncertainty to a point where we ultimately sustain balance in the economy, then we will get that soft landing everyone is talking about. Which will ultimately give us more of those two-sided coins in our pockets!

Have a great weekend and enjoy this great fall weather!

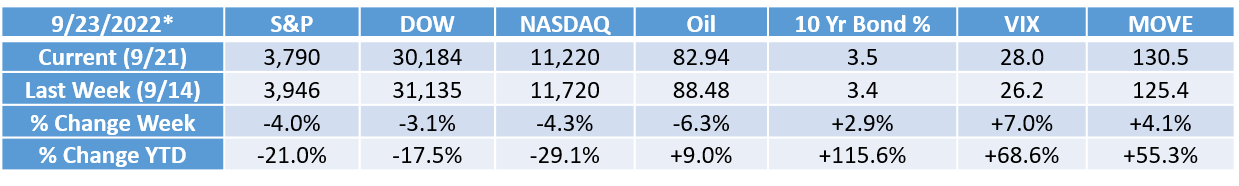

*all data sourced from Yahoo Finance as of the close on the date indicated

Disclosure

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Tracking #: 1-05330138