We continue to see more of the same this week with a market in flux as it continues to navigate a variety of issues that have unfortunately caused it to test new lows. Recession jitters came back not only on the heels of the Fed’s latest 75 bps rate hike but also after a rout in UK yields (to safer haven US Treasuries and German Bonds) which caused the Bank of England to step in and buy their bonds back to calm the markets over there. Back home, jobless claims came in at a 5- month low and PCE inflation came in hotter at 7.3% on Thursday, both of which infer the economy is not slowing down as the Fed has been saying would happen. Of course, the economy won’t slow down overnight but it is simply introducing jitters that further tightening by the Fed might be required. The debate continues.

This is obviously not fun for anyone but as investors, we should keep in mind there is history to look back on during times of stress and pressure in the markets and there are some key things to keep in mind. Like dollar cost averaging in, staying invested for the long term, and not trying to time the market.

As if the British bond crisis isn’t enough for the Eurozone, leaks from Russian natural gas pipelines are now being reported with a new leak discovered this week in the Nord Stream pipeline in the Baltic Sea. That brings the total number of “ruptures” to four, according to the Swedish Coast Guard. Gas has been bubbling up from the pipelines since earlier this week, with Denmark estimating the links would empty by Sunday. These pipelines are obviously integral to the energy infrastructure in Europe so this is going to be a potential challenge to supply over there and just adds to more possible pricing pressure like we have been seeing all year, especially in natural gas. Which is an area we recently added to our energy weighting in the GVA models with stocks EOG and LNG.

Also this week, Hurricane Ian crossed Florida and turned back towards South Carolina. More than 2 million homes and businesses in the state are without power, according to PowerOutage.us. The storm is expected to cause more than $65 billion in damages and losses, making it one of the costliest ever in the US. This will also add to possible pricing pressure in the energy space.

The name of the game right now is defense. Which has been our theme all year. It may also be time to consider the old saying “There Is No Alternative” (TINA for short) may be losing popularity these days as yields continue to creep higher. Meaning stocks were the obvious choice for years when interest rates were at all-time lows. Instead, a more appropriate saying could be “TARA” or “There Are Reasonable Alternatives”. This is the position we have taken in the GVA models as we continue to diversify in asset classes and sectors that make sense in this environment. Such as alternatives that offer better downside protection and lower correlation to the S&P 500 and even energy with a tweak towards natural gas.

As we close out the third quarter today, let’s look ahead to a more sustainable economy that starts with a steadier supply chain. Especially as we enter the holiday season. But keep a defensive posture until we see volatility come down. Enjoy the weekend and let’s see what the market brings on Monday.

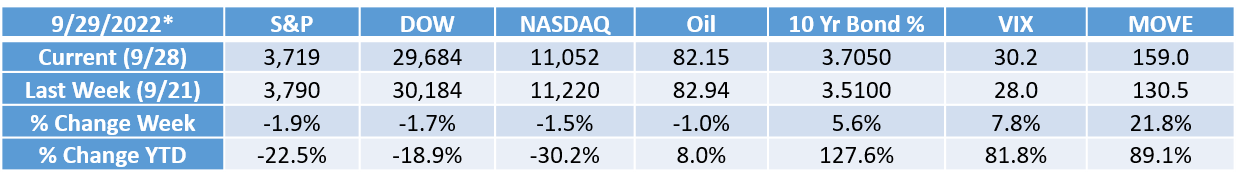

*all data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

Tracking#: 1-05332968