This week, we had our first full week of market action in 2023. And so far, we’ve been seeing a friendly market with mostly up days here as we begin the year. Could it be a sign of things to come? Maybe but I wouldn’t set my sights on that too soon because there is still a lot of “froth” to sift through in the markets. Case in point yesterday’s CPI report is just another data point to add to the mix. However, the good news is it did not cause any abrupt surprises as the results were pretty much in line with what was expected. But still, inflation is running at 6.5% y/y (down from 7.1% last month) so it is still very high. And if you think about where inflation was a year ago this time (7%) and now we are only at 6.5%, that’s really not much of a change relatively speaking. So, there is still work to do and we should fully expect the Fed to keep their foot on the gas when they meet again on February 1.

Speaking of keeping your foot on the gas, when you drive down a road and approach a bend you really don’t know what to expect around the corner there right? However, sometimes you can gather information from what cars are doing on the other side of the road. As far as if traffic is moving in the direction you’re heading. For example, if there is a traffic light around the corner and there are cars moving on the other side, you have a pretty good idea that you’ll have a green light in your lane coming out of the bend. In a way, this is similar to how we as investors think about the markets as far as looking ahead and wondering “what’s around the bend”?

To help answer that, we use droves of economic data like the inflation report released yesterday, various manufacturing signals, and even employment data such as the jobs report that came out last Friday. That showed 223,000 jobs were added in December and still points to a hot labor market where demand (companies looking for workers) outweighs supply right now (available workers). Which is still pointing us to inflationary signals in wage growth which the Fed is very much stuck on. For example, as of December, wage growth showed a 6.1% read, but the good news there is it is trending down. But it’s still very high. The other key thing to consider with inflation is the shelter component with is technically rent rates and again that continues to show a steady rate of rise with a +0.8% read last month. This is about a 1/3 contributor to CPI so if shelter is going to remain high then inflation will too. That, coupled with wage growth will definitely keep the Fed hiking, although maybe at a slower pace which the market is expecting. But the point is we are not out of the woods yet.

Then let’s take another look ahead signal from earnings. Which we are about to embark on in the coming weeks as companies report 4th quarter 2022. Obviously, the key to earnings is whether or not companies will guide up or down which will then cause analysts to do the same on their earnings projections. But the market will be paying a lot more attention to this dynamic this time around because we continue to stay in a high inflationary environment with plenty of uncertainty still lingering out there. Which leads us right back to margins, the lifeblood of any company’s P&L. The key though is what companies will guide out looking ahead as we continue to navigate a choppy and “sticky” environment, especially on the inflationary front. But if you look at where we stand today, the general consensus on 12-month forward earnings on the S&P 500 is 229. You can see that in Ed Yardeni’s projections (see page 1). Assuming a fair value forward P/E of 16.5, which you can also see in the FactSet Earnings Insight report, that projects to a year-end target on the S&P of 3,779. Which would be down 1.6% from the 2022-year end close of 3,840. Not all that exciting and of course a lot can happen between now and then, but the point here is that 229 is actually implying a +4.5% earnings growth over 2022’s finish at 219. You can see also that in Ed Yardeni’s projections (see page 1, 4.3%) AND on the most recent Factset Earnings Insight (page 14, +4.8%). So, at this point – before any earnings have come out – general consensus is for earnings growth this year. Yet at the same time the numbers are also projecting a slightly down market. BUT there has been A LOT of talk lately about earnings coming down and companies looking ahead to a slowing economy so that’s definitely not out of the realm to think about a scenario where companies could start projecting lower earnings. Case in point Macy’s recent guide lower. So that would in turn make analysists adjust their projections down going forward. Which could bring markets down even more. Not to paint a gloomy picture here but it’s certainly not out of the question as we sit here in January 2023.

Now the flipside to that is what if we get negative earnings on the year but with the market being a forward-looking entity it actually sees beyond that and goes UP? That is another very real scenario that could play out here because if you think about rates steadying this year and the economy getting back to its normal self-sustaining level where imbalances in supply chain resolve themselves, that’s a very real scenario as well. AND there is history to support that thesis too. For example, if you look at this Stern NYU data going all the way back to 1960 and do the math, you’ll see there have been 13 times earnings went down (negative growth y/y). Of those 13 years, 9 turned positive that same year in the market. That’s a pretty good stat right there. But if you look at the other 4 years, the market pretty much went down because of non-market event driven dynamics (the Gulf War in 1990, the tech bubble in 2001, housing crisis in 2008, European debt crisis in 2015). So technically, those remaining 4 years could have also turned positive had it not been for the event factor. That would have made it 13/13 on negative earnings but a positive growth market.

The point? Well even though we may have a negative earnings year doesn’t necessarily mean we will have a down year in the markets too. But the key as investors is to tactically plan around all of this both in the short and the long term. And to invest in sectors and asset classes that make sense in the environments we face. This is exactly what we do in the GVA Asset Management program and why as of this moment the asset allocation in the GVA models remains defensively positioned and focused on quality. Until we can see a little more clarity as far as which way the economy is heading. Just like approaching a bend on the road and slowing down to see what’s ahead, we are doing the same thing in the models. But we are also keeping an eye on what opposing traffic is doing to give us potential signs for what’s ahead in our lane. So that’s where we stand at the moment and we will continue to navigate this investment landscape best we can on that premise.

Have a great weekend and let’s see what turns the markets bring us next week.

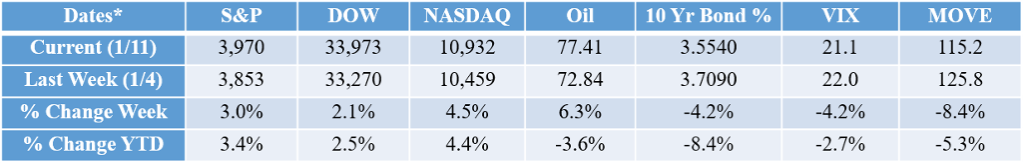

*All data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Compliance Tracking#: 1-05357371